O Balance Transfer Credit Cards: Maximize Your Savings Today

Balance transfer credit cards allow you to move existing debt to a new card with a lower interest rate. This can save money on interest.

Balance transfer credit cards are a popular tool for managing and reducing debt. They offer an introductory period with low or 0% interest rates. This period typically ranges from 6 to 21 months. Transferring high-interest debt to one of these cards can significantly lower monthly payments.

It also helps in paying off the principal faster. Most credit card issuers charge a balance transfer fee, usually around 3% to 5% of the transferred amount. Finding a card with minimal fees and a long introductory period is key. Always read the terms and conditions carefully to avoid hidden charges.

Introduction To Balance Transfer Credit Cards

Balance transfer credit cards offer a way to save money on interest. They help you pay off high-interest debt more efficiently. This guide explains what they are and how they work.

What They Are

A balance transfer credit card lets you move existing debt. You can transfer debt from one or more cards to a new card. This new card often has a lower interest rate, sometimes even 0% for an introductory period. This helps you save on interest and pay down debt faster.

These cards are designed to help manage your debt better. They offer a low or zero interest rate for a limited time. This period can range from six months to 21 months.

How They Work

To use a balance transfer credit card, you first need to get approved for one. Once approved, you can transfer your existing debt to this new card. The new card issuer pays off your old balances. Then, you owe the new issuer.

- Apply for a balance transfer credit card.

- Get approved and transfer your existing debt.

- Pay off the new balance during the low-interest period.

Remember, some cards charge a balance transfer fee. This fee is usually a percentage of the amount transferred. Always check the terms before transferring.

Here’s a simple table to summarize the steps:

| Step | Action |

|---|---|

| 1 | Apply for a balance transfer credit card. |

| 2 | Get approved for the card. |

| 3 | Transfer existing debt to the new card. |

| 4 | Pay off the balance within the low-interest period. |

Using a balance transfer credit card wisely can save you money. It can also help you become debt-free faster.

Credit: www.marketwatch.com

Benefits Of Balance Transfer Cards

Balance transfer credit cards offer many advantages. They can help you manage debt better. Let’s dive into the key benefits.

Lower Interest Rates

One of the biggest benefits is lower interest rates. Many balance transfer cards offer a 0% interest rate for an introductory period. This period can last from 6 to 21 months. This means your payments go directly to reducing the principal balance. You save money by not paying high interest. After the introductory period, the interest rate will increase. But, it’s often still lower than many standard credit cards.

Debt Consolidation

Balance transfer cards also help with debt consolidation. You can combine multiple debts into one credit card. This makes it easier to manage your payments. You only have to make one payment each month. This can reduce stress and simplify your finances.

Here’s a quick example:

| Debt Type | Original Interest Rate | Balance Transfer Card Interest Rate |

|---|---|---|

| Credit Card 1 | 18% | 0% (introductory) |

| Credit Card 2 | 20% | 0% (introductory) |

| Personal Loan | 15% | 0% (introductory) |

By consolidating these debts, you save on interest and simplify payments. This makes it easier to pay off your debt faster.

In summary, balance transfer cards offer lower interest rates and debt consolidation. These benefits help you manage and reduce debt effectively.

Choosing The Right Card

Choosing the right balance transfer credit card can save you money. This section will help you understand key factors to consider.

Interest-free Period

The interest-free period is crucial in a balance transfer card. It determines how long you can avoid paying interest. Look for cards offering at least 12 months of 0% APR. Longer interest-free periods give you more time to pay off your debt.

| Card | Interest-Free Period |

|---|---|

| Card A | 15 months |

| Card B | 18 months |

| Card C | 21 months |

Fees And Charges

Fees and charges can add up quickly. Consider the balance transfer fee, which is usually a percentage of the amount transferred. Some cards have no transfer fees for a limited time. Look for annual fees and late payment fees as well.

- Balance Transfer Fee: Typically 3-5% of the transfer amount.

- Annual Fee: Some cards have no annual fee.

- Late Payment Fee: Avoid late payments to save money.

Choose a card with the lowest fees to maximize your savings.

By focusing on these factors, you can choose the best balance transfer credit card. This will help you save money and manage your debt effectively.

Application Process

Applying for a 0 Balance Transfer Credit Card can save you money. Understanding the application process is crucial. This section will guide you through the necessary steps. We will cover eligibility criteria and required documentation.

Eligibility Criteria

Before applying, check if you meet the eligibility criteria. Each bank has its own rules. Common criteria include:

- Minimum age of 18 years

- Stable income source

- Good credit score

- U.S. residency or citizenship

A good credit score is crucial. It shows your ability to manage credit. Banks prefer applicants with a score above 700. Your income should be stable. This reassures the bank about your repayment ability.

Required Documentation

Gather all required documentation before starting your application. Missing documents can delay the process. Generally, you will need:

| Document | Purpose |

|---|---|

| Proof of Identity | Verify your identity |

| Proof of Address | Confirm your residence |

| Proof of Income | Assess your repayment ability |

| Credit Report | Check your credit history |

Your proof of identity can be a passport or driver’s license. For proof of address, use a utility bill or lease agreement. Proof of income includes pay stubs or tax returns. A recent credit report shows your credit history and score.

Having these documents ready speeds up the application process. Ensure all information is accurate. This avoids complications later.

Strategies For Maximizing Savings

Balance transfer credit cards can help save money on interest. To maximize savings, follow strategic steps. Focus on paying off your debt faster and avoiding new purchases. These strategies ensure you reap the full benefits.

Paying Off Debt Faster

Paying off debt faster reduces interest costs. Consider these steps:

- Create a Budget: Track your income and expenses. Allocate extra funds to debt repayment.

- Make Bi-weekly Payments: Split monthly payments into two. This reduces interest and speeds up debt payoff.

- Use Windfalls Wisely: Apply bonuses, tax refunds, or gifts directly to your balance.

Avoiding New Purchases

New purchases increase your balance and interest. Avoid them with these tips:

- Stick to Essentials: Buy only what you need. Avoid unnecessary spending.

- Use Cash or Debit: Pay with cash or debit to stay within budget.

- Track Your Spending: Monitor your expenses. Adjust your habits to meet your goals.

Implement these strategies to maximize savings with a balance transfer credit card.

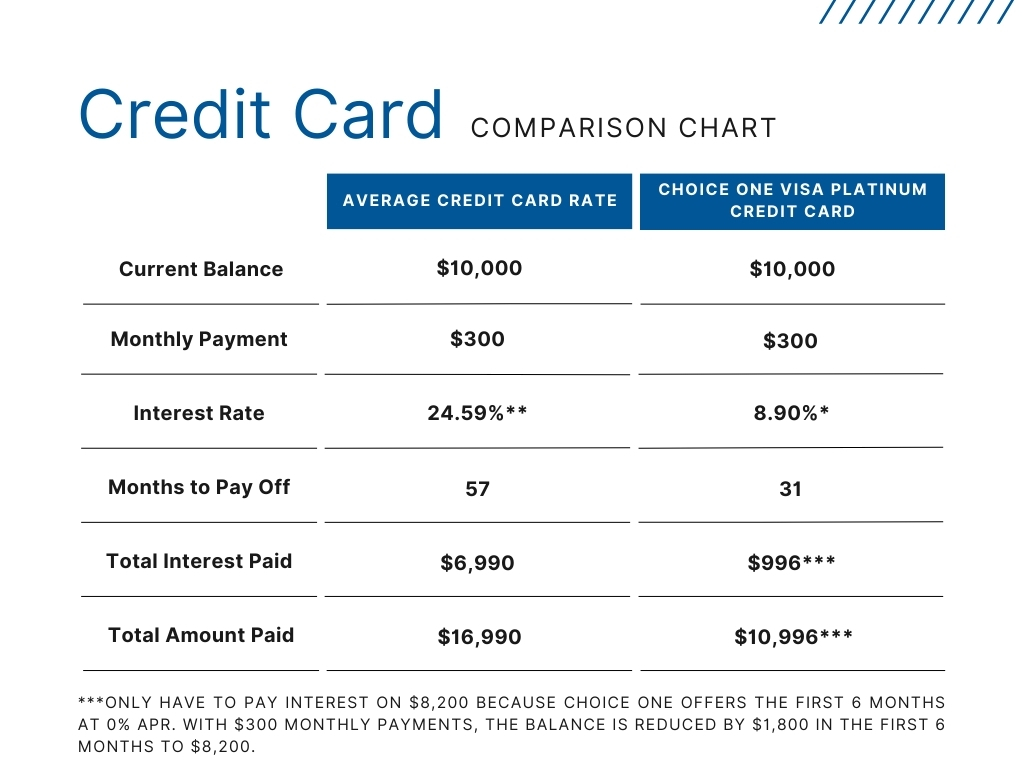

Credit: choiceone.org

Common Pitfalls To Avoid

O Balance Transfer Credit Cards can help manage debt effectively. Yet, many people fall into common traps. These pitfalls can hurt your credit score. They can also lead to more debt. Let’s look at some major pitfalls to avoid.

Missing Payments

Missing payments is a significant issue. Always pay on time to avoid fees. Late payments can increase your interest rate. They also damage your credit score.

Set up automatic payments to avoid missing due dates. You can also use calendar reminders. If you miss a payment, contact your credit card issuer immediately.

Exceeding Credit Limit

Exceeding your credit limit is another pitfall. Always keep track of your spending. A high balance can lead to over-limit fees. It also increases your debt-to-credit ratio.

Use budgeting tools to track your expenses. Stay below 30% of your credit limit. This helps maintain a good credit score.

| Common Pitfall | Impact | Solution |

|---|---|---|

| Missing Payments | Higher interest rates, late fees, damaged credit score | Set up automatic payments, use reminders |

| Exceeding Credit Limit | Over-limit fees, higher debt-to-credit ratio | Track spending, stay below 30% limit |

Case Studies

Case studies offer real-life examples of successful balance transfer credit cards. They show how people manage their debts. Here are some inspiring stories and lessons learned.

Successful Transfers

| Case | Debt Amount | Transfer Card | Outcome |

|---|---|---|---|

| John’s Journey | $10,000 | 0% APR for 18 months | Debt-free in 16 months |

| Sarah’s Success | $5,000 | 0% APR for 12 months | Debt-free in 11 months |

John’s Journey: John had $10,000 in debt. He used a 0% APR card for 18 months. He paid off his debt in 16 months. This saved him a lot of interest.

Sarah’s Success: Sarah transferred $5,000 to a 0% APR card. The promotional period was 12 months. She cleared her debt in 11 months. She also saved on interest.

Lessons Learned

- Plan Payments: Always plan your payments. Know your debt amount and timeline.

- Read Terms: Read all terms and conditions. Know the fees and rates.

- Stay Disciplined: Stick to your payment plan. Avoid new debts.

These case studies show the power of balance transfer credit cards. With careful planning and discipline, you can become debt-free.

Credit: m.youtube.com

Frequently Asked Questions

What Is A Balance Transfer Credit Card?

A balance transfer credit card allows you to move debt from one card to another. This can help you save on interest.

How Do Balance Transfer Credit Cards Work?

Balance transfer cards let you shift debt to a lower interest rate card. This reduces your interest payments.

Are There Fees For Balance Transfers?

Yes, most balance transfer credit cards charge a fee. Typically, it’s around 3-5% of the transferred amount.

Can Balance Transfer Credit Cards Improve Credit Score?

Yes, they can help improve your credit score. Paying off debt faster reduces your credit utilization rate.

Conclusion

Balance transfer credit cards can offer significant savings on interest. They provide a valuable tool for managing debt. Choose a card that fits your financial needs and read the terms carefully. Use it wisely to improve your financial health. Start your journey to financial freedom with the right balance transfer credit card today.